The Last Harvest, Part 2: Economic and Consolidation Pressures

Examining the corporate takeover of agriculture, how subsidies create dependencies, and the ripple effects on rural economies

[Authors note: this is the second in an eight-part series for an ongoing research piece and the analyses will be expanded with new research and insights. Please subscribe for further updates.]

THE LAST HARVEST SERIES

Synopsis

Part 1 of 8: Labor Market

Part 2 of 8: Economy & Policy (You are here)

Part 3 of 8: Historical Parallels

Part 4 of 8: Global Markets

Part 5 of 8: Water Resources

Part 6-8: [Coming soon]

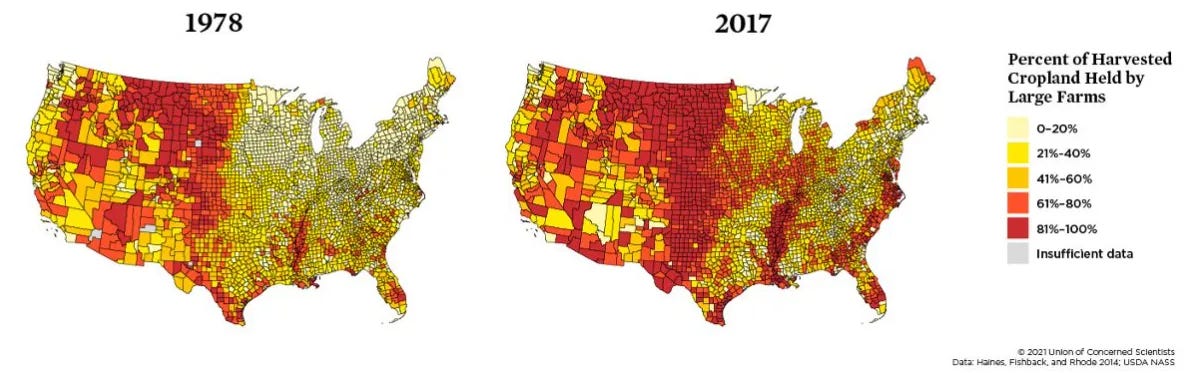

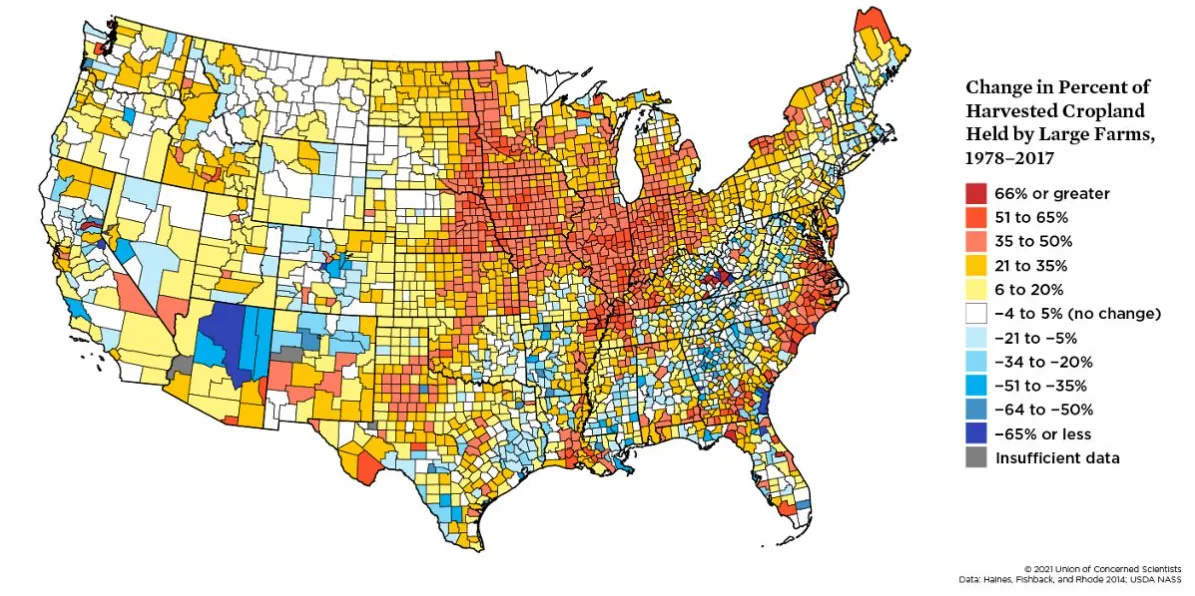

2.1. The Growing Consolidation

In just half a century, the U.S. has lost over an estimated 700,000 farms (142,000 of those between just 2017 and 2022), a decline that shows the sheer magnitude of consolidation in agriculture. According to the 2022 Census of Agriculture, the total number of farms in the U.S. has fallen below 2 million for the first time since before the Civil War.

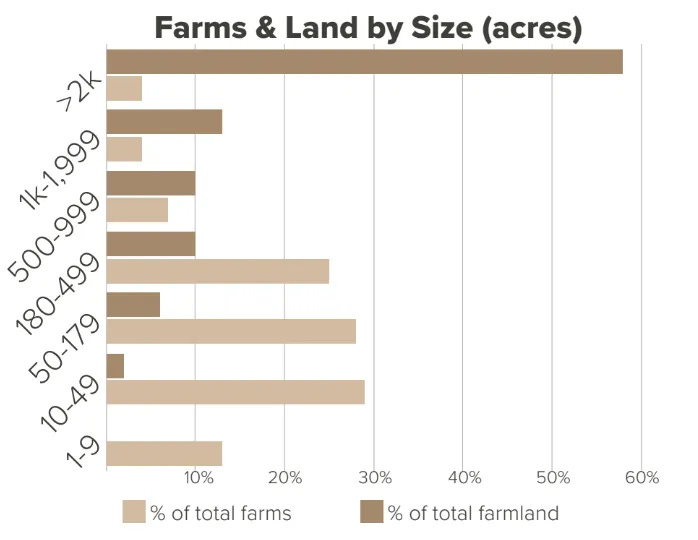

The dominance of large farms–whose efficiencies, scale, and technological advancements have driven agricultural progress in many ways–is reflected in their own prosperity: despite accounting for less than 1% of all farms, they generate over 40% of total agricultural sales. This shift is not inherently a problem, but as we will examine in the final section, such extreme concentration of farmland and production doesn’t just bring efficiency–it brings fragility. As consolidation accelerates, it creates risks that don’t just grow in size–they multiply in speed and unpredictability. The moment a crisis hits, the fallout will be immediate, widespread, and largely irreversible. Past shocks have been in finance, the internet, oil, steel, coal, and manufacturing. What happens when the next one involves our food?

2.2. The Farm Bill: A Fragile Lifeline

Farmers don’t operate in a free market. Decades of government intervention, subsidies, and regulations have shaped the economic landscape of agriculture—sometimes offering stability and food security, but often creating unintended dependencies that now threaten to collapse. This becomes evident in the paradox of the 2018 Farm Bill, a $428 billion package meant to stabilize the industry after the economic shock caused by the 2018-2019 trade wars. With the Farm Bill set to expire in 2024, and only a temporary one-year extension in place, the industry is staring down a future where these artificial support structures may vanish overnight.

2.3. The Subsidy and Regulation Levers: From Safety Net to Noose

[2/7/2025 URGENT EDIT: Last week I posted an article within 12 hours of the administration's freeze on federal grants and loans. If you followed the news you know there was mass confusion. I took it down less than 2 hours after posting as a supposed clarification came out and it seemed the ramifications were not going to be as widespread as I had assumed.

I've recently come across stories that some of my assumptions were in fact correct, which includes the massive ripple effects this is going to have on our economy (ESPECIALLY FARMERS AND RURAL COMMUNITIES). Here is the post with a letter and links for you to easily contact your Congressmen and women.

---

Government subsidies haven’t just assisted struggling farmers—they’ve also created a price system that corporations have learned to exploit. Many of these subsidies are tied to water usage, conservation efforts, or precision agriculture adoption, which introduces a new set of immediate threats in an era of labor shortages and economic instability:

Fewer Workers, Fewer Compliance Capabilities – With labor shortages accelerating, farms will struggle to meet the operational requirements for critical subsidies. Failing to comply means losing out on financial support they may be depending on.

Technology Incentive Gaps – Some subsidies require farms to integrate precision agriculture technology to qualify. However, with economic instability, fewer are less to adopt new technologies. With fewer workers available to operate, maintain, or train others on these systems, farms may be unable to comply, effectively locking them out of programs that were meant to keep them competitive.

Artificial Pricing & Markets – By publicly tying subsidies to specific crop yields and market conditions, corporate conglomerates have gained an unfair advantage–ensuring that farmers receive just enough to survive, but not enough to grow or adapt. This cycle keeps independent farms trapped while giving large agribusinesses the leverage to dictate market prices. This is further exacerbated at the global level discussed in the Geopolitical & Global Market Considerations section below.

The irony is inescapable: subsidies and regulations meant to protect farmers are, in many ways, accelerating their extinction. Credit is due to agribusiness giants for increasing efficiency and innovation, but their expansion has come at the direct cost of small farms—and by extension, rural America.

2.4. The Local Economic Fallout: A Chain Reaction That Won’t Stop at Rural Towns

Beyond the direct impact on farms, these shifts will have ripple effects that will devastate rural communities at a speed and scale most people aren’t prepared for. Unlike industrial farms–where profits are often extracted and funneled into corporate expansion–family farm income largely stays within the local economy. This distinction is critical.

When a family farm disappears, local economies suffer. Equipment dealers, seed suppliers, rural banks, and service providers all rely on the local farm economy to survive.

Corporate consolidation means fewer dollars circulate locally. The shift toward industrial farming means that profits flow upward to national and multinational agribusinesses rather than remaining within regional economies.

The domino effect accelerates rural collapse. As farming communities shrink, schools close, hospitals struggle, businesses shutter, and families are forced to leave. Less local tax revenue decreases the capabilities to provide needed services and critical infrastructure. This all creates a feedback loop of economic and social erosion.

These aren’t abstract concerns. This was a slow-moving trend at first—but rapid acceleration is happening right now, and it’s reached critical mass. The convergence of an aging farm demographic, severe labor shortages, accelerated consolidation, regulatory uncertainty, and trade policy (discussed in section 4) is driving rural America toward an immediate and self-perpetuating economic downturn. The tipping point isn’t about to come up—we have already begun to free fall.

As consolidation increases, micropolitan areas that are tied to food and farm goods and services will experience reduced demand. The increased concentration moves business to vertical giants. Small farms support regional food hubs, farmers' markets, and local supply chains that support both rural and urban food processing and distribution jobs. Corporate farms prioritize large-scale contracts and bypass regional distributors in favor of centralized logistics networks. This is when the surrounding and support of crumbling rural communities begins to crack their neighboring regional micropolitan areas.

2.5. The Uncertainty of the Next Economic Wave: How Many Will Survive 2025?

From direct conversations with Midwest farmers, many already expect to lose money in 2025—and we just entered February. Input costs continue to skyrocket—from fertilizer to wages to equipment—while subsidies remain in limbo and market pricing remains volatile and unpredictable. Meanwhile, new trade wars loom, and government policies continue to introduce both lifelines and landmines.

The question isn’t whether farms will struggle. It’s whether enough of them will survive. And as we turn to the global forces shaping these domestic conditions, the picture only becomes more complex, more volatile, and more dangerous.

The domestic farm economy does not exist in a vacuum. Many of the economic pressures we see today are symptoms of larger global forces. Trade wars, foreign competition, multinational agribusiness strategies, and shifting geopolitics are placing American farmers–especially small, family-owned farmers in rural America–at an unprecedented disadvantage in the global food economy.

In the section Geopolitical & Global Market Considerations section, we examine how foreign markets, tariffs and retaliatory tariffs, corporate pricing strategies, and export policies have created an economic battlefield where American farmers are losing ground fast. But first, as the saying goes: “History may not repeat itself, but it sure rhymes.”

THE LAST HARVEST SERIES

Synopsis

Part 1 of 8: Labor Market

Part 2 of 8: Economy & Policy (You are here)

Part 3 of 8: Historical Parallels

Part 4 of 8: Global Markets

Part 5 of 8: Water Resources

Part 6-8: [Coming soon]

[Author’s note: this complete series is in draft form. References, sources, and citations will soon follow. If for any reason you find material on here that you have copyright ownership to and would like for me to immediately include credit or remove complete, please email me directly at chris@questioningrural.com.]